Credit Union Owned Life Insurance – The State of the Union in 2023 and why Credit Unions are taking a second look in today’s interest rate environment.

Author: Dale Edwards

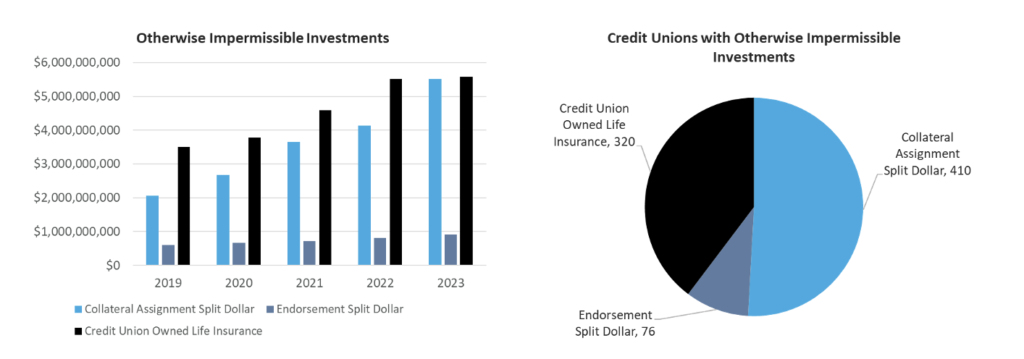

Credit Union Owned Life Insurance is one of several popular tools credit unions use to fund or offset employee benefits and to boost portfolio earnings. Other investments in life insurance, such as under a split dollar arrangement, are often used to deliver attractive and retentive employee benefit programs. In fact, as of end of the first quarter of 2023, over 56% of Credit Unions with assets greater than $500 million were utilizing split dollar, and over 44% were utilizing Credit Union Owned Life Insurance. Investments in these asset classes have experienced a compound annual growth rate of 27.83% for Split Dollar, and 12.35% for Credit Union Owned Life Insurance over the last five years.

So why is CUOLI purchased? The investment returns often offer attractive rates compared to other credit union investment alternatives, as well as providing key employee death benefit coverage. In essence, while CUOLI returns should be tied to benefit costs, it also needs to make sense relative to the credit union’s other investment options.

However, what happens when a CUOLI investment no longer provides attractive returns compared to other options? This is precisely the scenario we have seen play out over the last 6 to 9 months.

The Bond Market and CUOLI

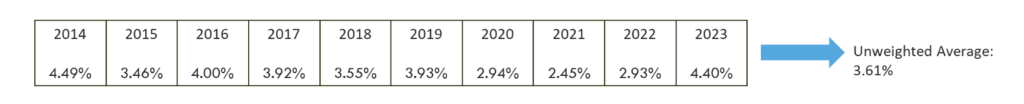

First, it is helpful to know how an insurance carrier delivers the returns on their fixed CUOLI insurance products. Insurance carriers are conservative institutions, like credit unions, and primarily invest in long-term bonds.

Example of Bond Laddering

Over this hypothetical 10-year period, Bond laddering results in slow movement in overall yields, up or down. However, during periods of significant change, overall portfolio yields can be out of step with current yields. When interest rates started their rapid upward trajectory late last year, the impact to laddered bond portfolio returns was negligible, as expected. This limits an insurance carrier’s ability to provide returns representative of current bond yields and results in below market returns on fixed return CUOLI.

Unsurprisingly, insurance carriers have experienced significant surrender activity of CUOLI from credit unions over the last six months, who are divesting of these underperforming assets. This has presented a myriad of challenges, not the least of which is a strain on the relationships between insurance carriers and credit unions. CUOLI products are designed to be held for extended periods and are not placed with an anticipation of an early surrender. During this same period, investments in split-dollar life insurance have continued to grow robustly.

In response to these actions, and to general competitive pressure, we are seeing carriers create new products separate from the existing portfolio, backed with only the more current bond purchases. These “new money” products immediately enjoy a higher crediting rate; however their introduction slows the recovery of the “old money” portfolio.

Opportunity Cost

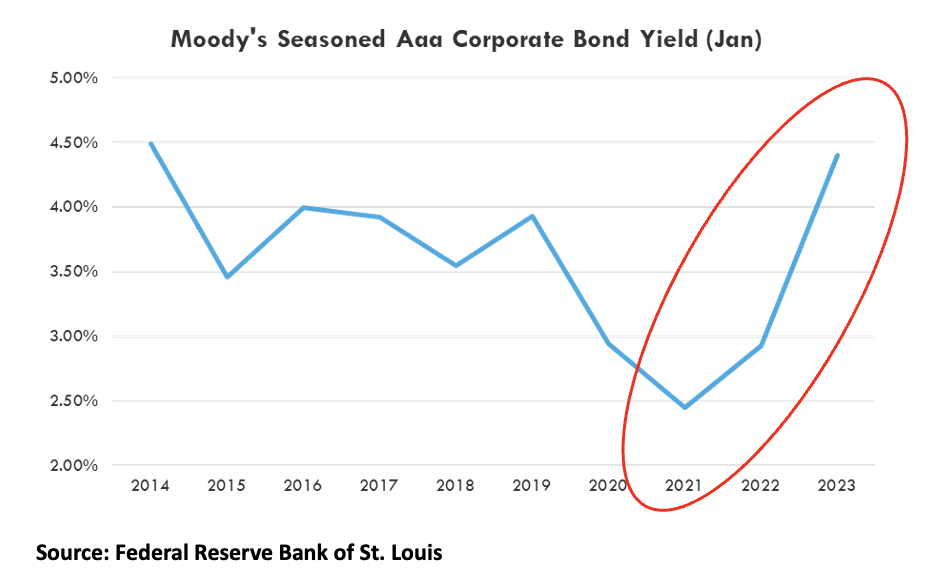

Another consideration for CUOLI in general is the opportunity cost of making such an investment. Credit Unions currently have attractive lending opportunities north of 7%, rates that cannot be replicated with any fixed return CUOLI products on the market.

While we are seeing an increase in crediting rates for fixed return CUOLI products, earnings in the mid 4% range still cannot compete well with the lending opportunities shown above. However, the cost associated with capturing a 7% lending opportunity is substantially higher than that of making a CUOLI investment.

Indexed Universal Life CUOLI

Another interesting option for CUOLI is Indexed Universal Life (IUL), which has become increasingly popular lately due to its more attractive earnings potential.

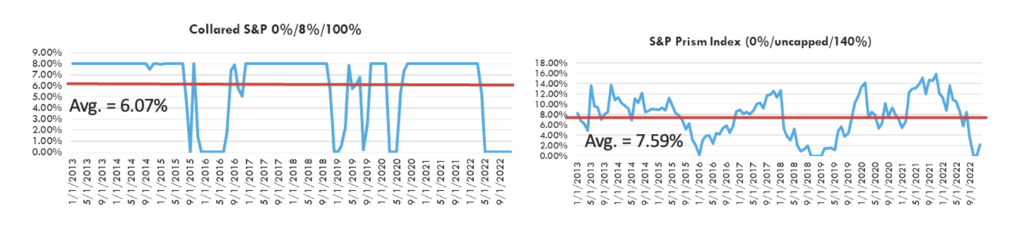

Over time, IUL can deliver returns in the 6% to 7.5% range with annual crediting subject to cap and floor rates. IUL can offer earnings generally more in line with market earnings expectations and has a similar risk profile to a bond. However, one thing to consider is its “lumpy earnings.” Meaning, earnings are usually credited once per year rather than every month, and will fluctuate between the cap and floor rate.

Many credit unions have become comfortable with this “lumpy” crediting in exchange for better market returns on their CUOLI investments, and have incorporated Indexed Universal Life into the mix with their more traditional fixed return CUOLI. We have also seen IUL CUOLI paired with 457(f) to deliver attractive and retentive benefits to key employees.

Deferred Compensation and Life Insurance

Utilization of Life Insurance as a proxy for cash in a deferred compensation arrangement is a strategy growing in popularity due to the tax advantages on the earnings within the life insurance contract. Meaning, life insurance earnings are not taxed so long as the policy stays in force for the life of the insured. This can have huge implications for organizations looking to manage the costs of a 457(f) deferred compensation plan. We saw one example that resulted in a savings of over $6 million for the organization to achieve the same retirement benefits. The Life Insurance policy was owned by the organization, and later transferred to the key employee upon vesting in the deferred compensation arrangement.

Compliance

On a final note, Credit Unions must consider NCUA’s examiner guidance on these types of investments, and the restrictions to be mindful of. First, Investments in Life Insurance are typically impermissible, other than when used to offset employee benefit costs. Credit Unions should exercise care when considering a CUOLI investment, and ensure it complies with Section 701.19 of NCUA’s rules regarding benefits for Federal Credit Union employees. Specifically, CUOLI may be used to recover the costs of funding and providing employee benefits. This means credit unions must quantify employee benefit obligations initially and on an ongoing basis to ensure alignment with CUOLI investment earnings. Credit Unions also have a concentration limit for such investments, not to exceed 25% of net worth, or 15% of net worth with any single insurance carrier or obligor. Lastly, IRS Code Section 101(j) has strict rules regarding the notice and consent of the employees upon whose lives the credit union owns life insurance. Compliance in this area is critical to maintaining the tax advantaged status of the death benefit proceeds.

The NCUA also provides a pre-purchase checklist to ensure credit unions are following proper due diligence prior to selecting a vendor and product. The guidance includes steps such as assessing the need and amount of CUOLI, the types of insurance available, vendor qualifications, product characteristics, financial health of the insurance carrier, an analysis of the risks, and other investment alternatives. The guidance also places a great deal of importance on the documentation of the due diligence process, the decision made and the policies in place to monitor compliance and performance of the assets.

Utilize a Trusted Advisor

Even in a high interest rate environment, CUOLI can be a sensible investment under certain circumstances. Credit Unions looking to assess their existing CUOLI portfolio or considering a CUOLI investment are encouraged to work with a trusted and seasoned partner who can help them navigate the options and the compliance aspects of such a transaction.